This might come as a surprise but your Financial Statements - the reports that your accountants are used to prepare - are not sufficient to accurately monitor the performance of your business(es).

The usual Financial Statements lack many variables to properly monitor your business(es) and take data-driven decisions.

The good news is that with few adjustments and the proper accounting solution, you can generate detailed internal reports - or the Management Reports - that will allow you to have an analytic approach and grow your business the right way !

What are Financial Statements and what do they lack?

Financial Statements are mandatory, compliance oriented, and mainly used for external purposes. They provide information to regulators, banks, investors, etc. With the Financial Statements, the ultimate goal is to provide general information about the financial position and performance of the company.

These reports show the overall picture of how your company is performing but don’t give you insights into the specifics of your operations like: which client or business unit is performing well, which department needs to cut costs, or how are you performing in relation to your industry’s KPIs, etc.

To find out more about these financial statements you can view our previous article “Financial Reporting:Taking it to the Next Level”

What are Management Reports and how can they help my business?

Management Reports are not mandatory and are meant for internal use. These reports are great tools for the Management team to analyze its business by segments and monitor specific KPIs (Key Performance Indicators). Thanks to the Management Reports, you’ll be able to make strategic decisions to improve your performances and work on your weaknesses.

1. Segmentation reports

Using segmentation, you can analyze your business in detail.

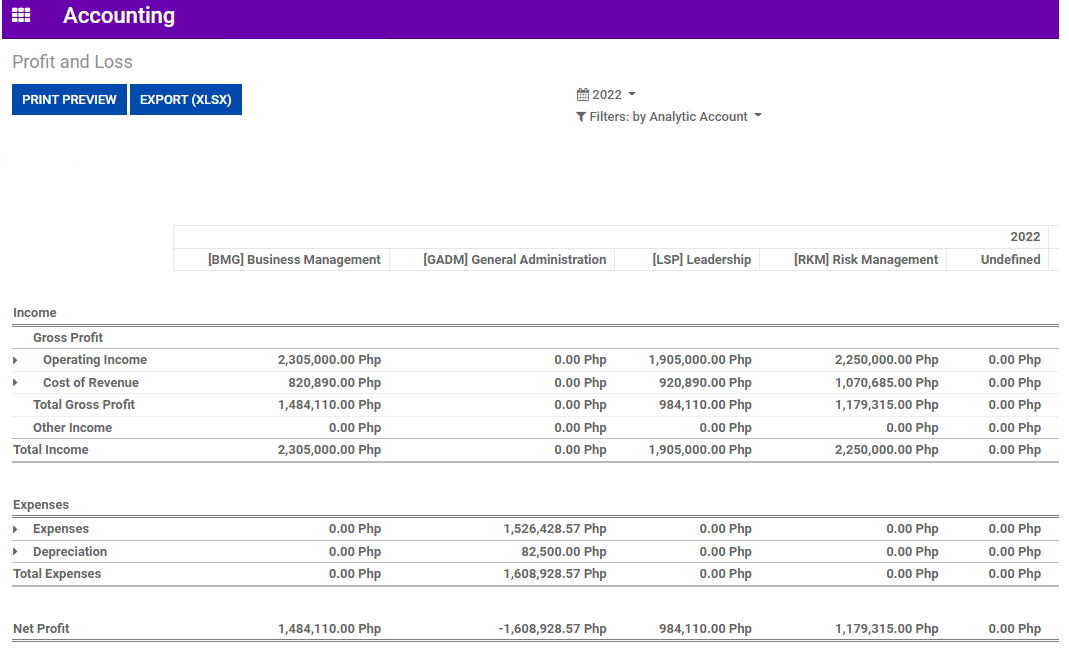

Management reports such as Profit and Loss by Class, Department, Project or Client are great to understand which areas of your business are profitable and which ones need to be examined and improved.

2. Key Performance Indicators (KPIs) reports

Through KPIs (Key Performance Indicators) businesses can define a set of quantifiable measurements to assess how the organization is performing in achieving the business’ objectives.

There are different types of KPIs:

Financial KPIs: usual financial KPIs include Solvency Ratios to monitor the long-term financial health of a company like Total-Debt-to-Total-Assets; or Profitability Ratios like Net-Profit-Margin.

Customer-focused KPIs: generally center on per-customer efficiency, customer satisfaction, and customer retention including Number-of-Resolved-Tickets or Customer-Satisfaction-Rating.

Process-focused KPIs: aim to measure and monitor operational performance across the organization like: Total-Cycle-Time which is the total amount of time needed to complete a process from start to finish; or Quality-Rate which focuses on the positive items produced instead of the negative.

To be even more pertinent, KPIs can be used per segment, for example you can analyze and set Net-Profit-Margin objectives per Business Unit.

3. Budget reports

Budgeting starts by setting performance objectives before year-end for the following year. Budget will of course include a projection of the regular Financial Statements - at least the Profit & Loss report - but you can also add additional elements like Segments and KPIs.

Then every month you compare your actual accomplishments with what was budgeted.

Budget reports are crucial in helping finance and management measure company performance. By examining the monthly planned vs. actual, you can determine if performances are in-line with the plans, and if not you have all elements to plan the steps and actions to get your business back on track.

How can I use my accounting software to generate Management Reports?

We will show some reports generated from the cloud-based solution Odoo Accounting. These are the standard reports and other modern accounting solutions would also allow you to prepare similar reports.

If your business requires complex management reports, the best solution would be to extract your financial data to a spreadsheet and prepare your management reports from there. Using Odoo Accounting, you can have a live pump between your Accounting module data and a Google Sheet, allowing you to generate live performance reports.

Profit & Loss per Analytic Accounts report

Financial KPIs report

Proseso Consulting - The finance expert for growing and international SMEs

For more information on General Accounting and Reporting or if you have any questions on how you can outsource your accounting functions, contact me directly at ninoy@proseso-consulting.com.

Proseso Consulting provides tailored business advisory and finances managed services (bookkeeping and accounting, outsourced and automated payroll, tax compliance, financial reporting, etc.). We are implemented in the Philippines and in France and our objective is to support the projects of ambitious companies and professionals. We are here to help you achieve your long-term business goals!

Ninoy Salmon is a seasoned business and finance professional with extensive experience working with both fast-growing startups and companies in the Philippines and around the world.

Get in touch with our team at contact@proseso-consulting.com or visit us at www.proseso-consulting.com for more information about our services.

This blog article does not constitute professional or legal advice. It is only intended to provide general information on a subject.